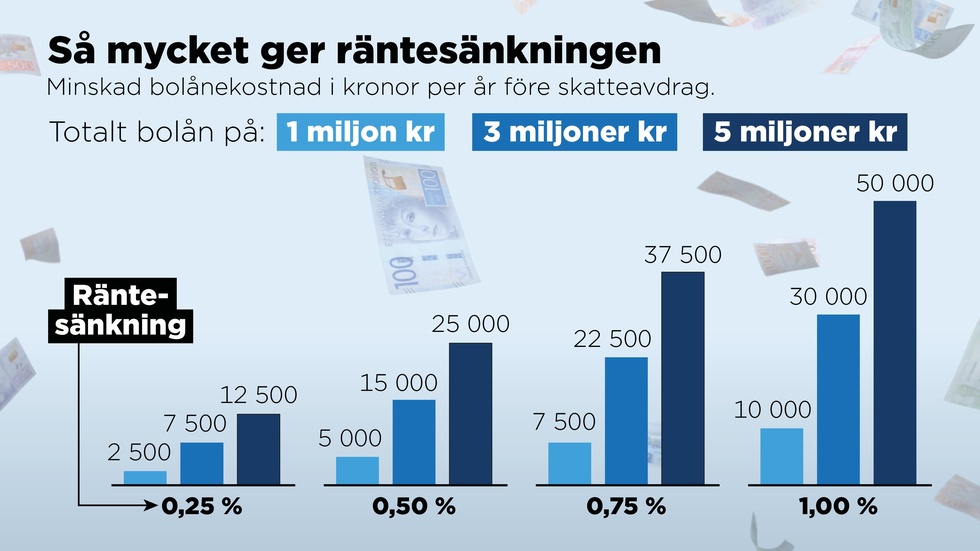

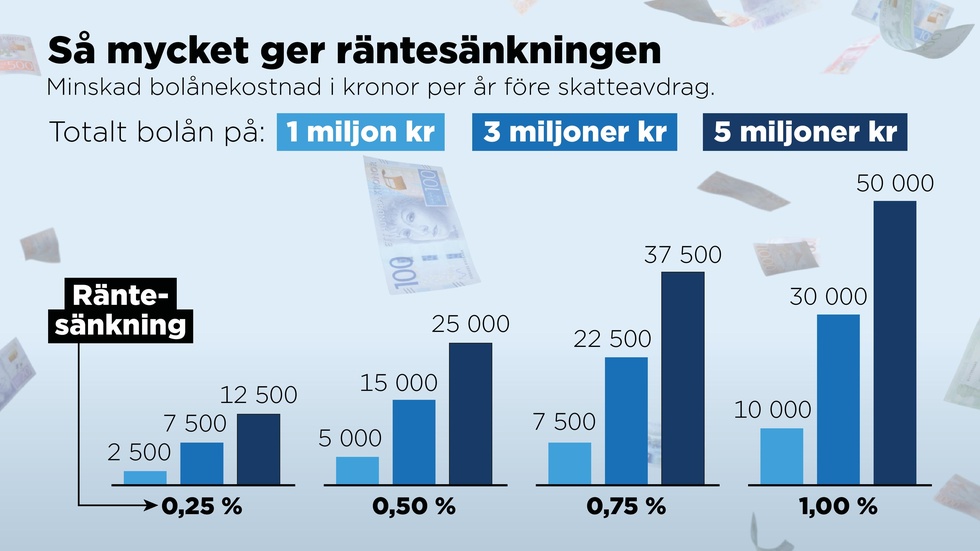

Following the first interest rate reduction in over eight years in May, and another cut this Tuesday, the central bank has indicated its intention to lower rates further. Even a modest rate cut can provide significant relief for homeowners with substantial mortgages. A quarter-point decrease on a one-million-kronor loan could result in savings of 2,500 kronor per year (before tax).

If the Riksbank follows through with four total cuts of 0.25 percentage points each, homeowners could see annual savings of 10,000 kronor on a one-million-kronor mortgage, or 30,000 kronor on a three-million-kronor mortgage.

– With multiple rate cuts, we could start to see a tangible impact on the wallets of homeowners, says Shoka Åhrman, savings economist at SPP.

How much the banks then choose to lower mortgage rates remains to be seen. Even before the Riksbank's announcement, several major banks have chosen to lower the interest rates on their mortgages.

– It's important to note that not every Riksbank rate cut will automatically translate into lower mortgage rates for borrowers, says Åhrman.

The decision to lock in a fixed interest rate or opt for a variable rate remains a common dilemma. In light of recent indications of potential interest rate cuts, more and more people are leaning towards variable rates. According to Länsförsäkringar, 95% of their customers chose variable interest rates in July alone.

– We know that interest rates are on the way down. Should one really fix the interest rate now? We don't think so. It's a bit too early, says Åhrman.

As always, it also depends on your own financial situation.

You may be on parental leave or studying and therefore want to know your exact monthly cost.

But what should you do with those extra hundreds or thousands of kronor in your wallet? If you've depleted your savings account, it's crucial to rebuild your reserves, says Åhrman.

– Building up a financial cushion is wise, especially given the potential for economic fluctuations, such as those caused by geopolitical tensions impacting energy prices, she explains.

If you've paused contributions to your pension or children's savings, now might be a good time to resume those payments, provided your financial situation allows.

– Once you feel more financially secure, consider allocating funds to these important areas, she advises.